August 2025 Labor Market Report: A Turning Point in the Post-Pandemic Economy

Fewer job openings and a flat quits rate highlight a market shifting in favor of employers, raising questions about the Fed’s next move on interest rates

Include a personal profile or introduction statement at the top of your resume

Fermentum quis tincidunt nunc dui egestas. Vel fringilla odio amet sed dignissim purus id aliquam commodo egestas parturient viverra tincidunt viverra condimentum adipiscing consectetur placerat odio justo neque neque. Tristique adipiscing purus platea quis blandit sollicitudin tortor magna vulputate condimentum nullam lorem pharetra lorem et urna.

- Erat scelerisque eu dui diam varius in proin sit elementum amet vitae et.

- Enim elementum bibendum habitasse mauris at amet aliquet morbi risus.

- Ipsum ultrices sit massa amet nulla lobortis justo pharetra metus mattis felis.

- Tempor sollicitudin et maecenas aliquam turpis suspendisse non eget.

Add an infographic element that displays your best traits and accomplishments

Fermentum quis tincidunt nunc dui egestas. Vel fringilla odio amet sed dignissim purus id aliquam commodo egestas parturient viverra tincidunt viverra condimentum adipiscing consectetur placerat odio justo neque neque. Tristique adipiscing purus platea quis blandit sollicitudin tortor magna vulputate condimentum nullam lorem.

Use headings and subheadings throughout your resume to highlight key sections and make the information easier to read

At montes at ut arcu ut faucibus tempor pretium. In lobortis id nisi cursus massa vel volutpat mauris. Turpis vitae mi nibh gravida id adipiscing. Convallis turpis pellentesque bibendum velit facilisi. Quam vitae lacus nullam lorem adipiscing suspendisse quis tortor aenean. Massa ipsum accumsan arcu.

- Feugiat in feugiat egestas scelerisque eget phasellus ipsum imperdiet.

- Convallis nulla id quis suspendisse enim molestie sed feugiat neque egestas.

- Natoque in massa mi quis. Mi amet sed curabitur in urna venenatis sem.

- Id viverra sed pellentesque rhoncus eu gravida suscipit et vulputate.

Utilize space by using bullet points to outline skills and job qualifications

At montes at ut arcu ut faucibus tempor pretium. In lobortis id nisi cursus massa vel volutpat mauris. Turpis vitae mi nibh gravida id adipiscing. Convallis turpis pellentesque bibendum velit facilisi. Quam vitae lacus nullam lorem adipiscing suspendisse quis tortor aenean. Massa ipsum accumsan arcu.

“Nec nunc morbi dolor volutpat a ullamcorper fusce gravida condimentum sit turpis nunc est vitae ornare augue odio nec varius sed”

Incorporate visuals and images such as graphs and charts

At montes at ut arcu ut faucibus tempor pretium. In lobortis id nisi cursus massa vel volutpat mauris. Turpis vitae mi nibh gravida id adipiscing. Convallis turpis pellentesque bibendum velit facilisi. Quam vitae lacus nullam lorem adipiscing suspendisse quis tortor aenean. Massa ipsum accumsan arcu.

U.S. Labor Market Report: August 2025

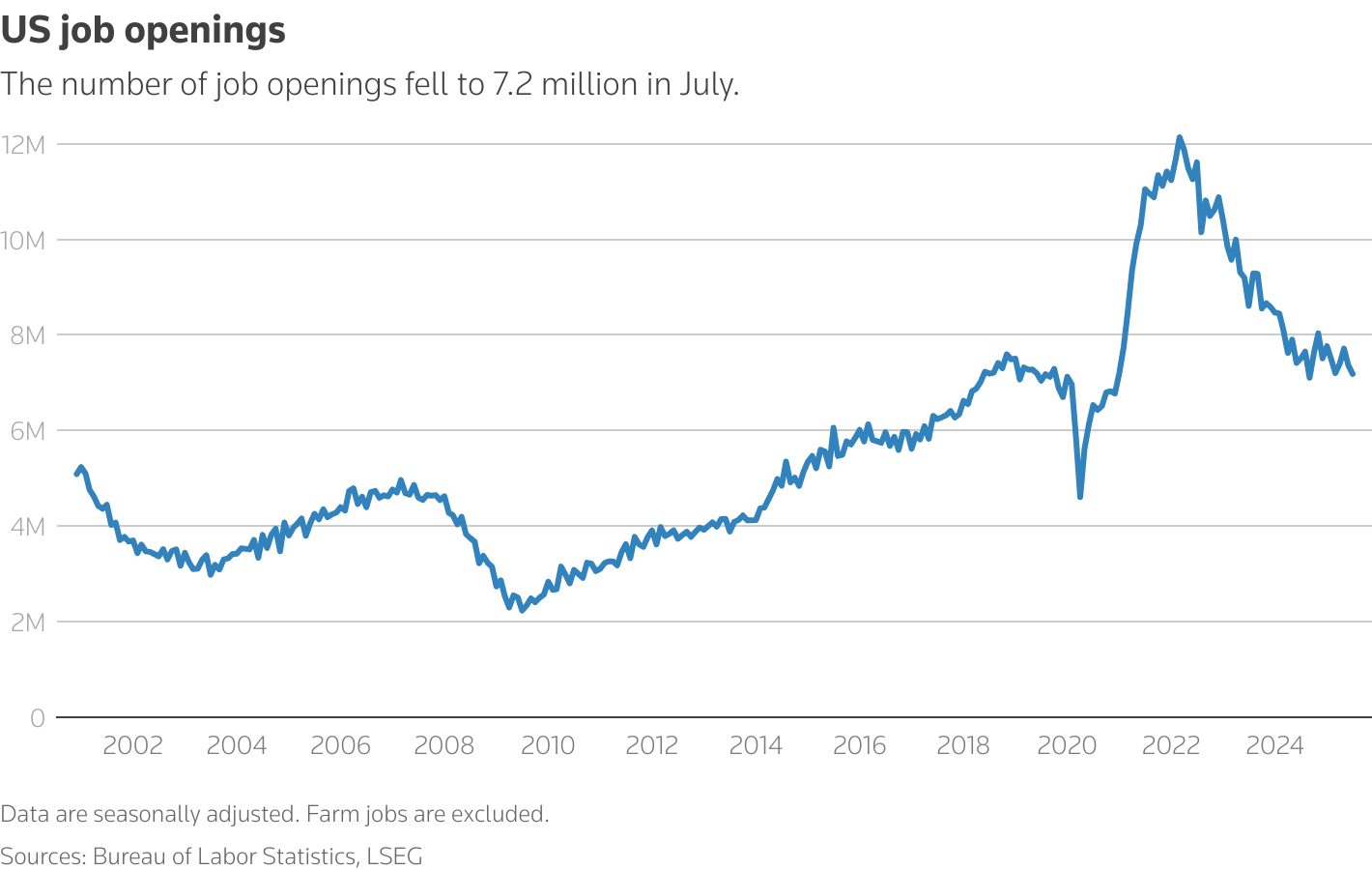

The U.S. labor market showed further signs of cooling in August, reinforcing expectations that the Federal Reserve may pivot toward interest rate cuts later this month. Job openings fell to their lowest level in ten months, hiring momentum remained subdued, and workers are displaying less confidence in switching jobs. Taken together, the latest data suggest that the long stretch of worker-friendly conditions that defined the post-pandemic years is now firmly giving way to an employer-favorable environment.

Key Takeaways

- Job openings slipped to 7.18 million by the end of July, a decline of 176,000 from June and more than 300,000 lower than two months ago.

- The ratio of job openings to unemployed workers fell below 1.0 for the first time since April 2021, signaling that job seekers now outnumber available positions.

- Hiring rose modestly to 5.31 million, with most gains concentrated in wholesale trade, manufacturing, and smaller service sectors.

- Layoffs stayed low at 1.81 million, showing employers remain reluctant to part with workers despite weaker demand.

- Quits held steady at 2.0%, a far cry from the highs of 2021–2022, reflecting reduced worker confidence.

These indicators point not to an outright collapse, but to a labor market in transition: cooling, but not yet breaking.

Sector Highlights

The slowdown is uneven across industries, with clear pockets of weakness and relative strength:

- Healthcare and social assistance, a sector that has powered much of the labor market’s resilience since the pandemic, shed 181,000 openings in July. This was its second straight monthly decline, and a significant shift given its outsized role in job creation.

- Retail trade lost 110,000 vacancies, underscoring the pressure from cooling consumer demand as households scale back discretionary purchases.

- Arts, entertainment, and recreation fell by 62,000 openings, continuing a retrenchment in discretionary spending categories that often serve as leading indicators of economic sentiment.

- Offsetting these declines, construction, manufacturing, and financial activities reported modest gains in job postings, while federal government vacancies rose by 18,000, largely tied to immigration enforcement hiring.

This divergence underscores a broader story: some segments of the economy remain on relatively stable footing, but the engines of broad-based growth are slowing.

Broader Economic Context

The labor market slowdown does not exist in a vacuum. It is unfolding against a backdrop of softer consumer spending and higher business costs. Tariffs introduced earlier in the year have raised input costs for many firms, forcing them to rethink hiring and expansion. At the same time, immigration restrictions have constrained labor supply, leading to mismatches in certain industries even as total vacancies fall.

Despite these pressures, employers appear reluctant to return to the aggressive layoffs of past downturns. With fresh memories of pandemic-era hiring challenges, many firms are choosing to hold on to staff, even in the face of weaker demand. Instead, they are adjusting through slower recruitment, reduced hours, or attrition. This explains why layoffs remain low, providing a degree of stability even as opportunities for job seekers become scarcer.

Worker Confidence and the Quits Rate

Perhaps the clearest sign of a cooling labor market is the behavior of workers themselves. The number of people voluntarily quitting their jobs (a proxy for confidence in finding better opportunities) held steady at 3.2 million in July, keeping the quits rate at 2.0% for a fourth consecutive month.

This stands in sharp contrast to the “Great Resignation” period of late 2021 and early 2022, when quits surged above 4.5 million and employees commanded significant bargaining power. The current plateau reflects an environment where workers are increasingly cautious: fewer job openings mean greater risk in leaving a role, while persistent inflation continues to erode real wage gains.

For businesses, reduced churn lowers costs associated with turnover and recruitment. For workers, however, it signals shrinking leverage in negotiations for higher pay or improved working conditions.

Policy Outlook

The Federal Reserve is watching these developments closely. The Beige Book, released in late August, highlighted an increase in individuals actively looking for work, aligning with the decline in job openings. Chair Jerome Powell has acknowledged the “rising risks” to the labor market, but continues to emphasize that inflation has not been fully tamed.

Financial markets are now broadly pricing in a rate cut at the September 16–17 Federal Open Market Committee (FOMC) meeting. Still, much depends on upcoming data, particularly the nonfarm payroll report and the consumer price index. These releases will determine whether the Fed feels confident enough to ease rates without reigniting price pressures.

The Labor Market in Transition

The August 2025 report makes clear that the U.S. labor market is undergoing a transition rather than an outright downturn. Job openings are declining, quits are falling, and hiring is subdued, but layoffs remain contained. This represents a slow normalization after several years of extraordinary imbalance between labor supply and demand.

For workers, this new environment means:

- Slower wage growth than in the peak post-pandemic years.

- Fewer opportunities to switch jobs with confidence.

- A gradual erosion of the bargaining power gained during the tight labor market of 2021–2022.

For employers, the shift may offer some relief from wage and staffing pressures, but it also signals softer demand that could weigh on revenues.

For policymakers, the challenge lies in navigating this middle ground: ensuring that labor market cooling does not tip into outright weakness, while guarding against inflationary risks that remain embedded in the economy.

Conclusion

The August data suggest that the U.S. labor market is bending, not breaking. Job openings and quits are sliding, reflecting both weaker demand and lower worker confidence, but low layoffs indicate that employers are not yet bracing for a severe downturn. The balance of risks is shifting: away from overheating and toward a more fragile equilibrium.

Whether this transition stabilizes into a “soft landing” or accelerates into something more disruptive will depend on the interplay between Fed policy, consumer spending, and business confidence in the months ahead.